Perth Current Housing Market Condition

Over the past few weeks, I’ve spoken with many buyers who are understandably concerned about purchasing in the current market, with prices at elevated levels and fears of a potential downturn. Unfortunately, I don’t always have the opportunity to explore these concerns in depth or provide the broader context behind them. This video may help put Perth’s current housing market into perspective.

While market fears are common, they are not always supported by the underlying fundamentals. Setting mining aside, Western Australia continues to diversify and develop a range of compelling industries focused on value-adding rather than simply extraction. Significant long-term investments, including the expansion of Perth Airport and the multi-decade AUKUS project commencing in 2027, are also expected to play a meaningful role in supporting the state’s economy.

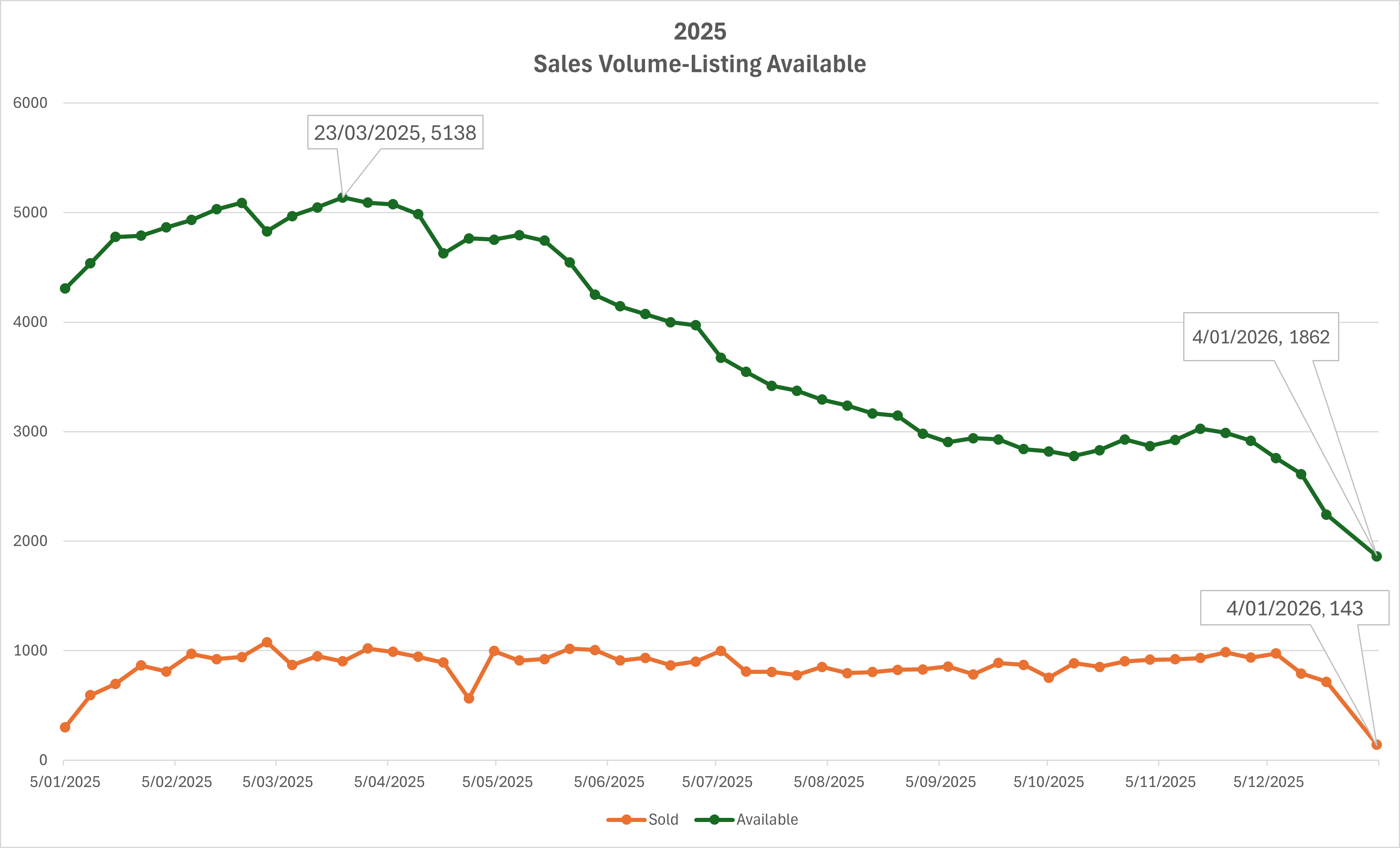

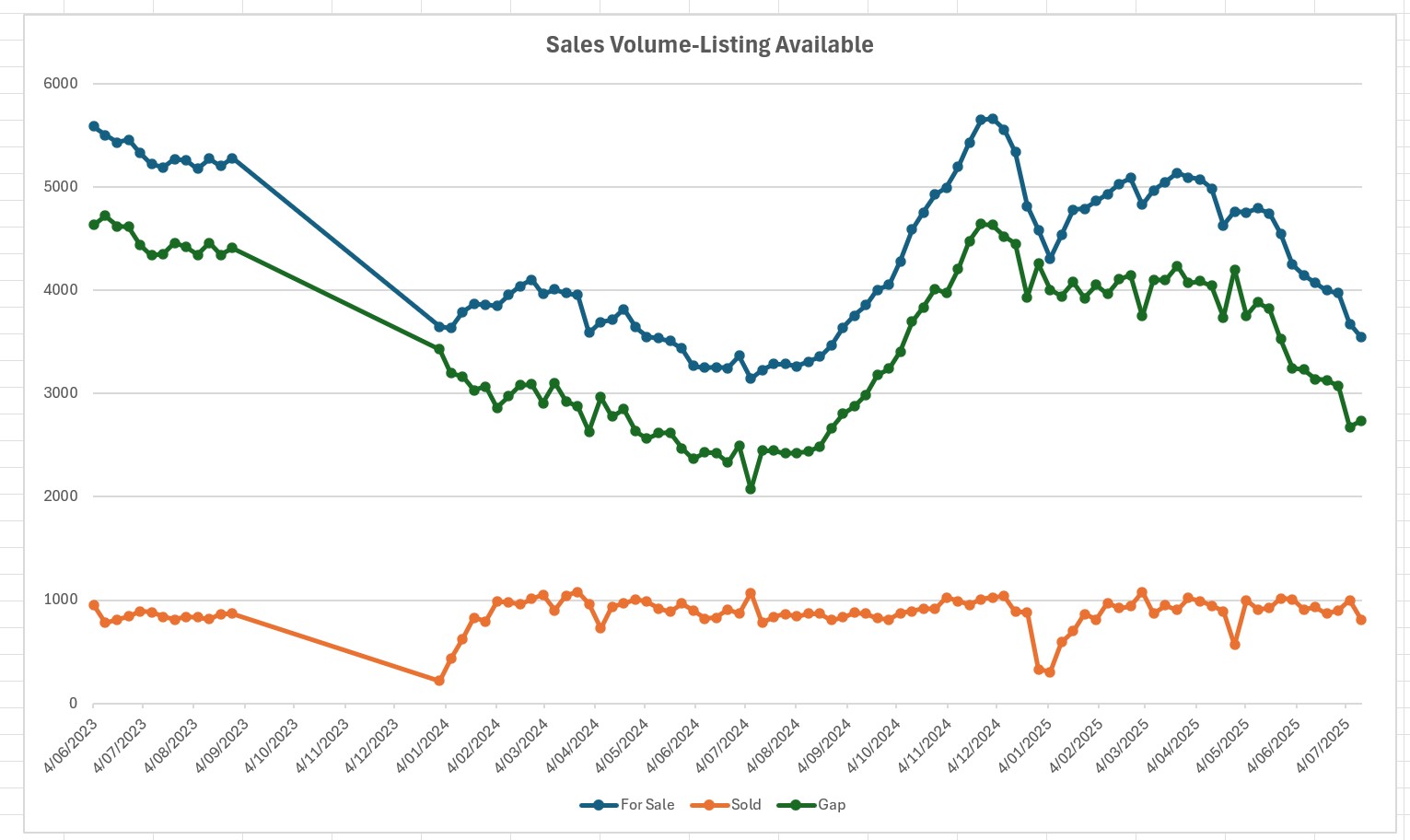

Tightening of listings

Looking at the Green line, available listings per week continues to tighten.

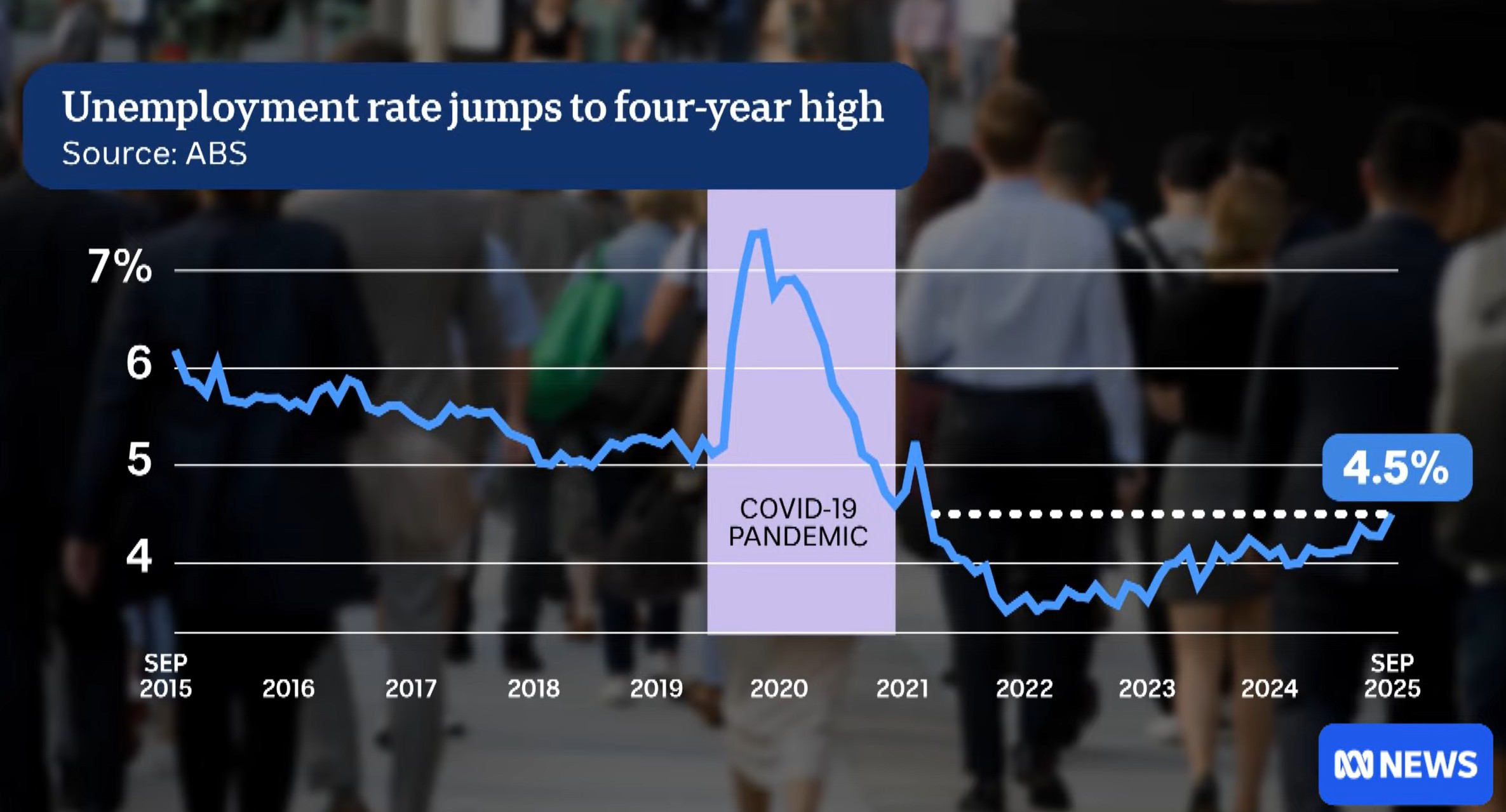

Australia's unemployment rate jumps to 4.5pc

Australia’s unemployment rate rose to 4.5 per cent in September (seasonally adjusted), up from 4.3 per cent in August, marking the highest rate since November 2021. The increase came amid a slowdown in employment growth: although about 14,900 jobs were added, the number of unemployed rose by around 33,900 as the labour force grew by about 48,800 and the participation rate ticked up to 67 per cent. Economists say the la...

Higher property price caps for first home buyers from 1 October 2025

CLICK BELOW:

From 1 October 2025, the Scheme will remove limits to the number of Government guarantees available, giving all Australian first home buyers the chance to enter the market with a deposit of as little as 5% and avoid Lenders Mortgage Insurance. Plus, Higher property price caps for first home buyers.

Which Lender is passing on the August RBA Interest Rate Cut & When?

Interested in finding out whether your lender is passing on the August rate cut and when are they passing it on?

Here's a list from Finder.com.au: CLICK HERE

RBA's Decision

At its meeting today, the Board decided to lower the cash rate target by 25 basis points to 3.60 per cent.

More details: CLICK HERE

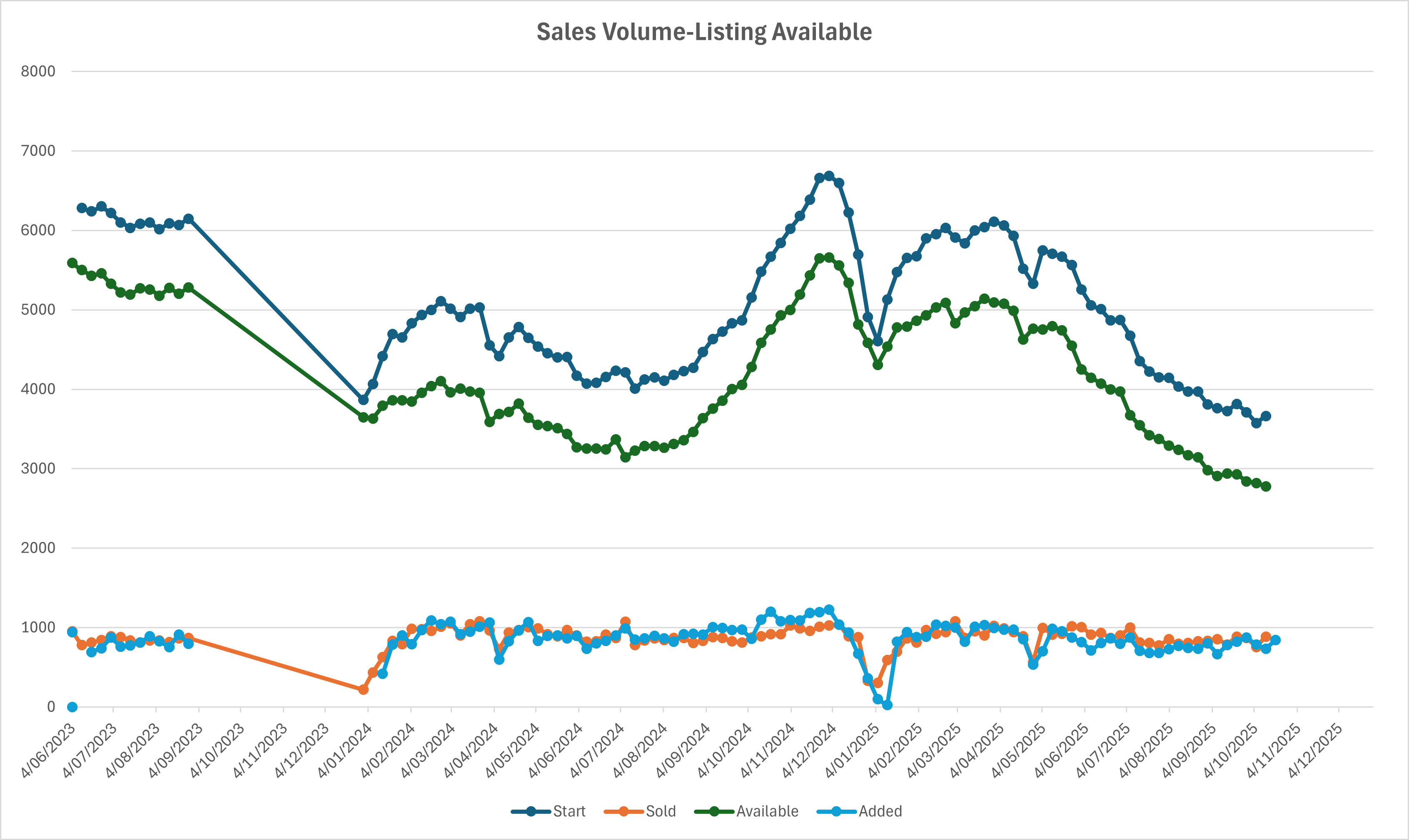

FY24-25 Weekly Data

Weekly Market Trends: 30 June 2024 – 13 July 2025

During the period from 30 June 2024, the property market experienced a clear cycle in the number of listings available for sale each week:

- The weekly "For Sale" listings initially dropped to a low of 3,144 on 7 July 2024, marking the tightest supply point during this timeframe.

- From that low, listings began increasing steadily, peaking at 5,661 on 1 December 2024, an 80% rise in inventory over five months.

- Since December 2024, there has b...

Keystart has introduced several initiatives to enhance affordable housing access for Western Australians.

Summary

Modular Construction Home Loan

-

New Low Deposit Loan: Introduced for modular homes, requiring only a 2% deposit.

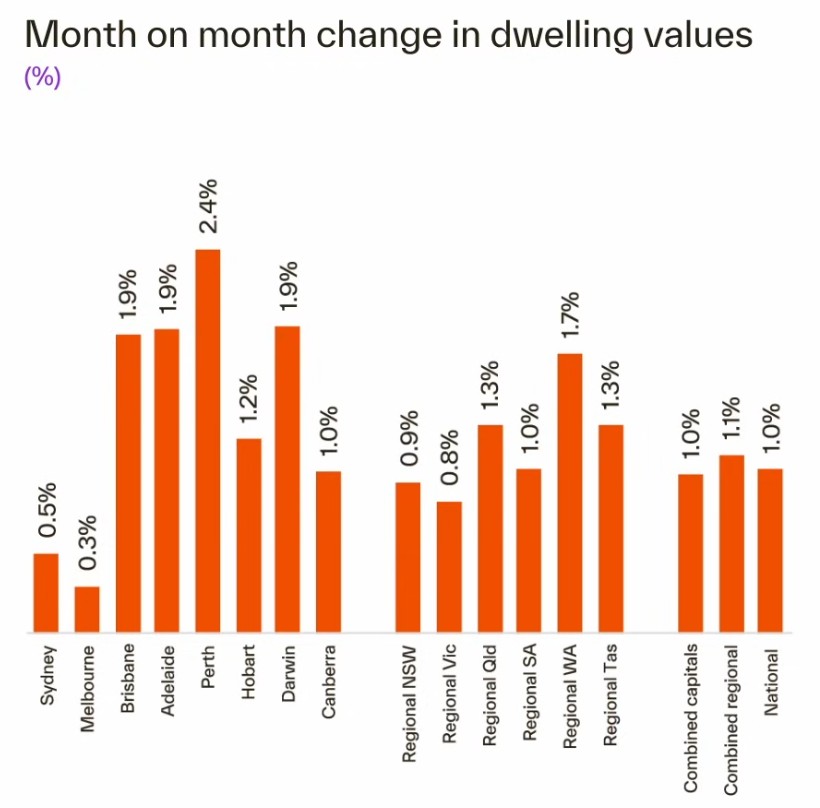

Perth’s Median Home Value Surpasses Melbourne for the First Time in a Decade.

Full Article: CLICK HERE

Despite Melbourne leading monthly gains, Perth’s median home value of $787,000 has overtaken Melbourne’s at $782,000 for the first time in a decade. This reflects Melbourne’s relative weakness compared to Perth’s persistent outperformance in recent years and affordability-driven demand.

RBA Cuts Interest Rate Amid Cooling Inflation

On May 20, 2025, the Reserve Bank of Australia (RBA) reduced the official cash rate by 25 basis points, bringing it down from 4.10% to 3.85%. This marks the second rate cut this year, reflecting the central bank's response to easing inflation and a weakening global economic outlook .

The RBA's decision comes amid a decline in inflation, with the March quarter showing a 2.4% headline inflation rate and a 2.9% underlying inflation rate, aligning with the RBA's target range of 2–3% .

Banks P...

Changes to First Home Buyer Duty Assessment

The Western Australian Government has announced significant changes to the First Home Owner Rate (FHOR) of duty and the Off-the-Plan Duty Concession, effective for transactions entered into on or after 21 March 2025. These adjustments aim to make homeownership more accessible for first-time buyers.

Click Here for more information: External link to wa.gov.au site

Perth Housing Market Update | April 2025

Perth's Housing Values are virtually unchanged since October 2024.

RBA’s data shows mortgage pain for thousands of West Australians

As this article is behind the paywall, I will do a quick summary of it here.

Recent data from the Reserve Bank of Australia (RBA) reveals significant mortgage stress among Western Australian (WA) homeowners. Here's a breakdown of the key points:

- High Mortgage Burden: The RBA classifies 9.8% of WA borrowers as having a high mortgage burden, indicating that a substantial portion of homeowners are allocating a significant share of their income to mortgage repayments.<...

REIWA reports Perth's median prices continue their upward trend

REIWA reports Perth's median prices continue their upward trend

REIWA reports Perth's median prices continue their upward trend

Perth’s Crime Hotspots Revealed: Which Suburb Topped the List in 2024?

As crime rates surge across Perth, new data reveals the suburbs hit hardest in 2024. The CBD remains the most crime-ridden area, with thousands of reported incidents, while Northbridge and Midland also saw alarming spikes. Theft, property damage, and car break-ins are on the rise, leaving residents concerned about safety. Authorities point to economic struggles as a driving factor and are ramping up efforts to curb the trend. What’s behind this crime wave, and what can be done to turn the tide?

Click the link below for the full article:

When will your bank pass on the rate cut?

Now that the RBA has cut the cash rate by 0.25% to 4.10% on 18-02-2025, the key questions are:

- How much will your bank pass on? and

- When will your bank pass on the rate cut?

Below is a chart of financial institutions that have announced their plans.

* Chart from: https://www.rba.gov.au/statistics/cash-rate/

* Table tabulated from: https://www.savings.com.au/news/rba-rate-cut-february-2025#anzContinue reading

The Reserve Bank of Australia has cut the official cash rate from 4.35 to 4.10 per cent. (Effective 19-02-2025)

The Reserve Bank of Australia (RBA) has lowered interest rates for the first time in four years, reducing the cash rate to 4.1%.

This decision follows a period of holding rates steady at 4.35% since November 2023—the highest level in 13 years.

The Australian Government is tightening restrictions on foreign purchases of existing homes and land banking.

16-02-2025

The Albanese Government is introducing stricter measures to address Australia’s housing crisis by limiting foreign investment in residential properties. From April 1, 2025, to March 31, 2027, foreign investors will be banned from purchasing established homes, with few exceptions. This aims to increase housing availability for Australians.

Additionally, the government is cracking down on land banking, where foreign investors buy vacant land but delay development for profit. ...

Perth weekly market snapshot for the week ending 9 February 2025

Perth weekly market snapshot for the week ending 9 February 2025

(https://reiwa.com.au/the-wa-market/perth-metro/)

Sales transactions in Perth last week were up 20.9 per cent on the previous week, with REIWA members reporting 970 transactions. A closer look shows house sales were up 17.3 per cent compared to the week prior, unit sales were up 16 per cent and land sales were up 71.2 per cent.

Top performing suburbs – sales

Baldivis – 21

Perth – 19

...